Monthly Construction Input Prices Decreased in November, Says ABC

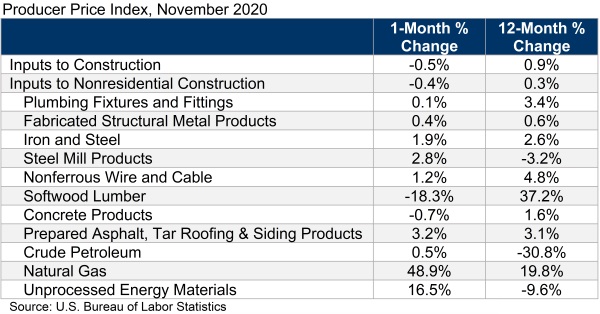

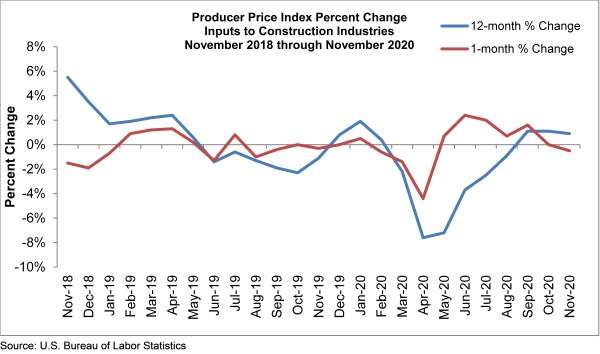

WASHINGTON, Dec. 11—Construction input prices fell 0.5% in November compared to the previous month, according to an Associated Builders and Contractors analysis of the U.S. Bureau of Labor Statistics’ Producer Price Index data released today. Nonresidential construction input prices fell 0.4% for the month.

Construction input prices increased 0.9% between November 2019 and November 2020. Nonresidential construction input prices are up just 0.3% over that span. Once again, the relatively larger increase in overall construction input prices is attributable to softwood lumber prices, which are 37.2% higher than in November 2019.

“There has been some upward pressure on certain input prices in recent weeks, including energy prices,” said ABC Chief Economist Anirban Basu. “This is a natural outgrowth of a strong economic rebound from the earlier stages of the pandemic and efforts by a group of suppliers to constrain the supply of inputs, particularly of oil.

“There are now signs, however, that the pace of economic recovery in the United States and in many other parts of the world has slowed meaningfully,” said Basu. “Employment growth has stagnated. The November reading of ABC’s Construction Backlog Indicator was the lowest level since the beginning of 2011. Further slowing is likely due to spiking infection rates among many nations. In the near-term, this will likely dampen the pace of input price inflation. There are also seasonal factors at work, as the winter months tend to be associated with reduced construction spending volumes.

“While input price inflation is unlikely to represent a major challenge for contractors in the near-term, there is a possibility that input prices could surge at some point next year,” said Basu. “Once vaccinations become broadly available, the global economy is likely to gallop forward, creating significant growth in demand and driving prices higher. Those contractors who utilize softwood lumber are especially aware of such dynamics.

"Earlier this year, suppliers were unprepared for the rush of softwood lumber package orders as the U.S. single-family housing construction market took off,” said Basu. “The result was a profound increase in softwood lumber prices, which has since begun to abate as the quantity supplied catches up to the quantity demanded. The bottom line is that contractors should be aware of the possibility of rapidly rising input prices at some point next year as they enter into contractual commitments.”