ABC’s Construction Backlog Rebounds in October; Contractor Confidence in Sales and Profit Margins Falls

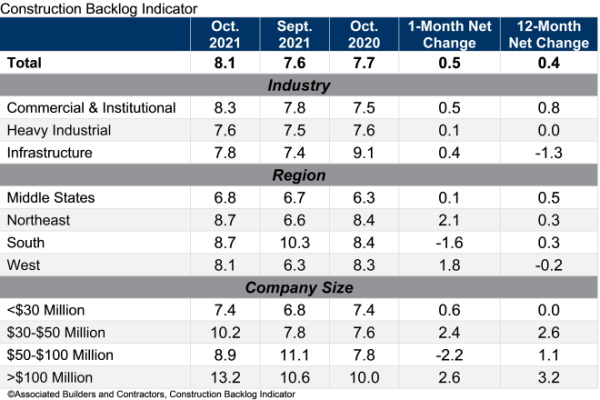

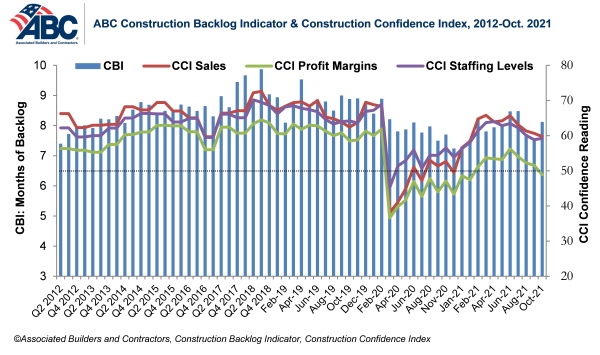

WASHINGTON, Nov. 9— Associated Builders and Contractors reports today that its Construction Backlog Indicator rose to 8.1 months in October, according to an ABC member survey conducted from Oct. 20 to Nov. 2. The reading is up 0.5 months from September 2021 and 0.4 months from October 2020.

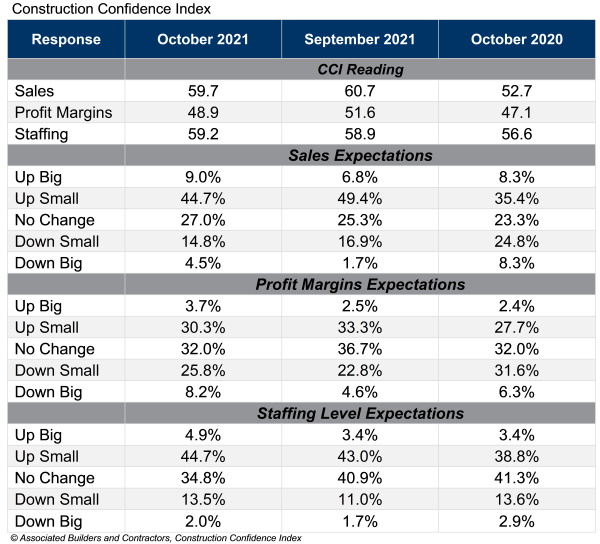

However, ABC’s Construction Confidence Index readings for sales and profit margins declined in October, while the index for staffing rose slightly. The sales and staffing readings are still above the threshold of 50, indicating expectations of growth over the next six months. The index for profit margins fell below that threshold, pointing to expectations of decline.

“After declining for two months, nonresidential construction backlog bounced back in October,” said ABC Chief Economist Anirban Basu. “But some of the renewed momentum appears to be at the expense of profit margins. ABC’s Construction Confidence Index indicates that the average contractor expects profit margins to dip over the next six months. The implication is that contractors are finding it difficult to pass along all the cost increases caused by higher materials prices.”

“The good news is that demand for construction services remains elevated despite weaker economic growth and a stalled federal infrastructure package,” said Basu. “With interest rates low and liquidity high, many investors are seeking positive rates of return through investment in real estate and new construction. Partially as a result, contractors continue to expect sales and employment to grow in the near term. It may be that many project owners have adjusted expectations about construction costs and are ready to move forward despite them. If that stays true, backlog should continue to rise from current levels.”

Note: The reference months for the Construction Backlog Indicator and Construction Confidence Index data series were revised on May 12, 2020, to better reflect the survey period. CBI quantifies the previous month’s work under contract based on the latest financials available, while CCI measures contractors’ outlook for the next six months.